Writers block

Lots of interesting stuff happening in the markets right now but I have lacked the motivation/inspiration to make a post lately. Apologize, hopefully we'll be back in action soon.

Wednesday, March 18, 2009

Wednesday, February 25, 2009

Tax refunds

Ok, so it's that time of the year again. Everyone has either already received or is anxiously awaiting their tax refund. I mean it's a sweet deal, right? Every year all you have to do is fill out a few pieces of paper, pay a tax man a few dollars and YOU GET MONEY. The best part is it's not even taxable!

But lets take a step back and see why a refund may not be such a sweet deal. First of all we must examine what a refund actually is. For starters it is not the IRS giving you money, it is simply them giving you back the money they shouldn't have taken. The only way that you can actually be given money is if you can qualify for a tax CREDIT like the Earned Income Tax Credit or the New First time Home Owner Tax Credit. This is a brilliant plan by the IRS because they have somehow turned tax time into a happy time for most working class citizens. Except for those of us that have a lot of investments or passive income we can't wait to file and get our returns!

Most people get such gigantic returns because they are raising tax shelters (children) and did not properly account for them when they initially filled out their W-4 forms when they started work. Thus every week/bi-weekly/monthly the IRS is taking more money from your take home pay than they actually should. Essentially what it boils down to is an interest free loan to the government. Now this doesn't make a HUGE difference to each individual family but nationally it adds up fast. Since I have yet to raise any tax shelters of my own I honestly have no idea how big the average tax returns are but lets assume they are on average $1,500. Lets extrapolate that over the roughly 150,000,000 person workforce. Nationally this is a $225,000,000,000 interest free loan to the US Treasury. A loan this size invested in even in a very conservative account yielding 3% amounts to $6,750,000,000 (that is $6.75 billion for those of you keeping score at home). I have NO IDEA what these figures would actually look like and I can't find any sources that say how much IRS gives out in rebates every year. I just used these numbers to make a point

Now assume lets assume the situation is reversed and you underpay your taxes the IRS will be nice right? NOPE. The stated interest rate for first quarter 2009 was 5% interest on deficient payments to the IRS. You can expect to be penalized .5% a month for late returns which increases to 1% per month once you've been notified of intent to levy. If you just "forget" to file your return and you do actually owe money you can expect a 5% per month fee of net taxes due + interest. This is one reason most people make huge over payments on their taxes because they are scared to cut it close.

An even bigger ripoff than a tax return though is getting a refund anticipation loan from H&R Block. In early 2000's they settled a lawsuit regarding the structure of these loans. Generally the money is lent for approximately 10 days and the customer is given cash on the spot minus fees and then the refund goes straight to H&R. In a recent investigations the Consumer Federation of America found that the refund anticipation loans charged APR as high as 774%. U.S. tax prepares generated fees totally approximately $810 million for these ten day loans. That's $810 million less dollars per year in the pockets of the poorest Americans. Ouch...

While I'm on this rant the last thing I was very surprised by was when my own mother, who is selfless enough to actually bother trying to help struggling children in one of North Carolina's poorest school districts, was telling me about the program the school had for extending teachers and school employees pay over the summer. They actually take money from your pay and hold it aside in a separate account and pay it out to you over the summer. The account doesn't even pay INTEREST!!! As if teachers and school employees aren't sacrificing enough already. Come on! Again on an individual level it may not seem like much, what's interest on a few thousand dollars but think of all the teachers in North Carolina. That's one big pool of money. The state is making some serious money on that deal. At least pay the interest back out to the school district or use it for short term loans to fund school programs. Who knows maybe they do, but expecting government to be transparent in their spending is probably not going to happen anytime soon.

That's all for now. Have a great week and enjoy those tax refunds. Don't forget to put some aside for a rainy day.

Sources : http://www.consumerlaw.org/issues/refund_anticipation/content/RAL_final.pdf

TRC

But lets take a step back and see why a refund may not be such a sweet deal. First of all we must examine what a refund actually is. For starters it is not the IRS giving you money, it is simply them giving you back the money they shouldn't have taken. The only way that you can actually be given money is if you can qualify for a tax CREDIT like the Earned Income Tax Credit or the New First time Home Owner Tax Credit. This is a brilliant plan by the IRS because they have somehow turned tax time into a happy time for most working class citizens. Except for those of us that have a lot of investments or passive income we can't wait to file and get our returns!

Most people get such gigantic returns because they are raising tax shelters (children) and did not properly account for them when they initially filled out their W-4 forms when they started work. Thus every week/bi-weekly/monthly the IRS is taking more money from your take home pay than they actually should. Essentially what it boils down to is an interest free loan to the government. Now this doesn't make a HUGE difference to each individual family but nationally it adds up fast. Since I have yet to raise any tax shelters of my own I honestly have no idea how big the average tax returns are but lets assume they are on average $1,500. Lets extrapolate that over the roughly 150,000,000 person workforce. Nationally this is a $225,000,000,000 interest free loan to the US Treasury. A loan this size invested in even in a very conservative account yielding 3% amounts to $6,750,000,000 (that is $6.75 billion for those of you keeping score at home). I have NO IDEA what these figures would actually look like and I can't find any sources that say how much IRS gives out in rebates every year. I just used these numbers to make a point

Now assume lets assume the situation is reversed and you underpay your taxes the IRS will be nice right? NOPE. The stated interest rate for first quarter 2009 was 5% interest on deficient payments to the IRS. You can expect to be penalized .5% a month for late returns which increases to 1% per month once you've been notified of intent to levy. If you just "forget" to file your return and you do actually owe money you can expect a 5% per month fee of net taxes due + interest. This is one reason most people make huge over payments on their taxes because they are scared to cut it close.

An even bigger ripoff than a tax return though is getting a refund anticipation loan from H&R Block. In early 2000's they settled a lawsuit regarding the structure of these loans. Generally the money is lent for approximately 10 days and the customer is given cash on the spot minus fees and then the refund goes straight to H&R. In a recent investigations the Consumer Federation of America found that the refund anticipation loans charged APR as high as 774%. U.S. tax prepares generated fees totally approximately $810 million for these ten day loans. That's $810 million less dollars per year in the pockets of the poorest Americans. Ouch...

While I'm on this rant the last thing I was very surprised by was when my own mother, who is selfless enough to actually bother trying to help struggling children in one of North Carolina's poorest school districts, was telling me about the program the school had for extending teachers and school employees pay over the summer. They actually take money from your pay and hold it aside in a separate account and pay it out to you over the summer. The account doesn't even pay INTEREST!!! As if teachers and school employees aren't sacrificing enough already. Come on! Again on an individual level it may not seem like much, what's interest on a few thousand dollars but think of all the teachers in North Carolina. That's one big pool of money. The state is making some serious money on that deal. At least pay the interest back out to the school district or use it for short term loans to fund school programs. Who knows maybe they do, but expecting government to be transparent in their spending is probably not going to happen anytime soon.

That's all for now. Have a great week and enjoy those tax refunds. Don't forget to put some aside for a rainy day.

Sources : http://www.consumerlaw.org/issues/refund_anticipation/content/RAL_final.pdf

TRC

Bailout in perspective

Sorry I've been overcome by a total lake of motivation lately. I'm almost done catching up with "Lost" so maybe I'll get back to my goal of at least weekly postings. Here is something to get you busy while you wait though.

How much did the bailout cost? As many have been quick to point out the numbers are getting so big now no one really knows when in the hell they really represent anymore. Here is a breakdown that may help you picture the cost. Note the taxes box, we may be getting a tax cut now but someone is going to have to pay for it later.

(click to view larger picture)

Source : www.right.org if you are in a good mood now and wish you were pissed off.

Source : www.right.org if you are in a good mood now and wish you were pissed off.

How much did the bailout cost? As many have been quick to point out the numbers are getting so big now no one really knows when in the hell they really represent anymore. Here is a breakdown that may help you picture the cost. Note the taxes box, we may be getting a tax cut now but someone is going to have to pay for it later.

(click to view larger picture)

Source : www.right.org if you are in a good mood now and wish you were pissed off.

Source : www.right.org if you are in a good mood now and wish you were pissed off.

Tuesday, February 17, 2009

More humor

Thursday, February 5, 2009

Wednesday, February 4, 2009

A Bailout for the Little Guy

I have always dreamed while working out if only I could immediately see the results of working out for two years before I did anything! If I could be immediately granted 30 pounds of weight loss and toned muscles and in exchange for this I would have to agree to workout regularly for the next two years. Essentially if I was fronted the results of working out for two years and if at any point during those two years I didn't make good on my workout plan I would go back to being Mr. Flab. I know this would make me much more likely to do the work. Well unfortunately for me this is not available to those of us that struggle to get into the gym on a daily basis but for your average consumer almost anyone can sign this kind of contract. Yeah, it's that little piece of plastic you have in your pocket. Unfortunately for most of us, you'll actually end up doing four years of work to eventually get what you could have gotten in only two years if you had bothered to save first, spend second. Have no fear though! Thanks to Uncle Sam we can now get fronted the cash we need without any cost (sort of).

Right now there is a nice little tax perk to anyone who goes out on a limb an purchases their first home. A program that was started in July of 2008 that is set to expire at the end of June is essentially an interest free loan of $7,500. The way this works if you are fronted the $7,500 in exchange for agreeing to pay Uncle Sam an extra $9.61 cents a week.....for the next fifteen years. It's actually structured so that you pay $500 back every year when you file your taxes. Since most of us get a tax return anyway you'll hardly miss it. Pile on top of that the fact that you'll be paying a lot of interest in the first few years of the loan and all of that is tax deductible and you really are getting a sweet deal. Bailout 2.0 which is making its way through congress right now is set to increase this to bailout to $15,000 and extend it to everyone, not just first time home buyers. By the way, the estimated cost of this ENTIRE program is only 19 Billion. I say only because it accounts for only 2.1% of the bailout package. Now I'm not a huge fan of just throwing money to anyone who can open their eyes wide enough to catch it but if Uncle Sam is determined to toss money around, it's nice to see the little guy get some. My favorite part about this legislation is probably the fact that I may actually end up being able to personally benefit from it. In my head I can actually see how something like this may work. In a downward spiraling market trying to find the bottom is like trying to catch a falling knife. Sure it's possible but very hard to do without getting hurt. Instead, what most people would prefer to do is let the knife hit the floor and then pick it up. Right now, the problem is, there is no floor! This is an incentive for people who are contemplating home purchase to get out there and start looking, making bids and getting into new homes. To me this SEEMS like it should help stabilize the market and help establish a bottom. It also doesn't give unequal treatment to people who were irresponsible and bought more than they could afford. This would give people a little bit of working cash to possibly get into a manageable fixed rate mortgage and stop some of the foreclosure mess. It also gives lenders a larger group of people they can possibly lend to since everyone comes into it with up to $15,000 even if they don't have anything! Instead of having to create fake documents so people can qualify for loans there may actually be people who can qualify all on their own! The fact that government can borrow so cheaply right now means this really won't cost that much, especially if people are required to pay it back. Also, when you take into account the breakneck pace at which the money supply is expanding (READ: inflation to come) the small amount people will be required to repay over future years will be inflated away and more than made up for by increasing wages and a recovering economy.

When you are trying to move a piece of rope from one place to another you don't try to push it. You grab it by the end and pull it where you want it to go. It looks like we may have finally gotten to the end of the rope and started to pull instead of pushing money into all these worthless insolvent financial institutions. We still have a lot of work to do and honestly we need to supply the credit to get the credit markets moving again but it's nice to see the rest of us might get a bone too! I don't know the real viability of this plan but at least we may get something out of this whole mess after all!

Breaking news story can be found here.

TRC

Right now there is a nice little tax perk to anyone who goes out on a limb an purchases their first home. A program that was started in July of 2008 that is set to expire at the end of June is essentially an interest free loan of $7,500. The way this works if you are fronted the $7,500 in exchange for agreeing to pay Uncle Sam an extra $9.61 cents a week.....for the next fifteen years. It's actually structured so that you pay $500 back every year when you file your taxes. Since most of us get a tax return anyway you'll hardly miss it. Pile on top of that the fact that you'll be paying a lot of interest in the first few years of the loan and all of that is tax deductible and you really are getting a sweet deal. Bailout 2.0 which is making its way through congress right now is set to increase this to bailout to $15,000 and extend it to everyone, not just first time home buyers. By the way, the estimated cost of this ENTIRE program is only 19 Billion. I say only because it accounts for only 2.1% of the bailout package. Now I'm not a huge fan of just throwing money to anyone who can open their eyes wide enough to catch it but if Uncle Sam is determined to toss money around, it's nice to see the little guy get some. My favorite part about this legislation is probably the fact that I may actually end up being able to personally benefit from it. In my head I can actually see how something like this may work. In a downward spiraling market trying to find the bottom is like trying to catch a falling knife. Sure it's possible but very hard to do without getting hurt. Instead, what most people would prefer to do is let the knife hit the floor and then pick it up. Right now, the problem is, there is no floor! This is an incentive for people who are contemplating home purchase to get out there and start looking, making bids and getting into new homes. To me this SEEMS like it should help stabilize the market and help establish a bottom. It also doesn't give unequal treatment to people who were irresponsible and bought more than they could afford. This would give people a little bit of working cash to possibly get into a manageable fixed rate mortgage and stop some of the foreclosure mess. It also gives lenders a larger group of people they can possibly lend to since everyone comes into it with up to $15,000 even if they don't have anything! Instead of having to create fake documents so people can qualify for loans there may actually be people who can qualify all on their own! The fact that government can borrow so cheaply right now means this really won't cost that much, especially if people are required to pay it back. Also, when you take into account the breakneck pace at which the money supply is expanding (READ: inflation to come) the small amount people will be required to repay over future years will be inflated away and more than made up for by increasing wages and a recovering economy.

When you are trying to move a piece of rope from one place to another you don't try to push it. You grab it by the end and pull it where you want it to go. It looks like we may have finally gotten to the end of the rope and started to pull instead of pushing money into all these worthless insolvent financial institutions. We still have a lot of work to do and honestly we need to supply the credit to get the credit markets moving again but it's nice to see the rest of us might get a bone too! I don't know the real viability of this plan but at least we may get something out of this whole mess after all!

Breaking news story can be found here.

TRC

Monday, January 26, 2009

Perspective?

Here is some perspective on how much money the fed has lent to financial institutions recently.

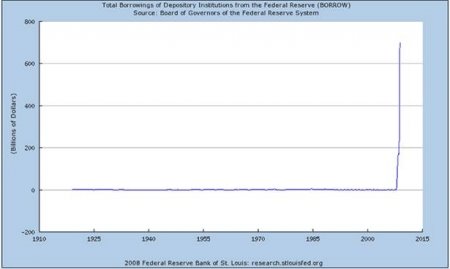

The first chart is a graph of the amount of money the Federal reserve lent to banks per year. As you can see this lending peaks in the 80's at nearly 8 Billion per year.

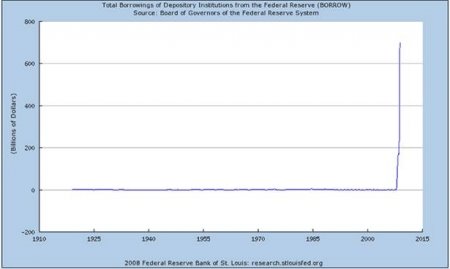

This second chart is the same graph on a new scale to fit the most recent federal reserve activity. Notice how you can't even see the bumps when we include this years lending topping out at over 600 billion.

Hats off to East Coast Economics; they published these graphs. Original article can be found here. Thought this would be interesting to share to help put a little perspective on what we are going through. Remember the Federal reserve is suppose to be the "lender of last resort." Right now banks can get money from the fed for 0.00% interest and then deposit it back with the Fed and earn .25% interest.

Hats off to East Coast Economics; they published these graphs. Original article can be found here. Thought this would be interesting to share to help put a little perspective on what we are going through. Remember the Federal reserve is suppose to be the "lender of last resort." Right now banks can get money from the fed for 0.00% interest and then deposit it back with the Fed and earn .25% interest.

I promise I will get back to making posts I had originally planned when I started the blog but keeping up with the most recent economic news has kept me pretty busy and it's just too important to completely ignore.

TRC

The first chart is a graph of the amount of money the Federal reserve lent to banks per year. As you can see this lending peaks in the 80's at nearly 8 Billion per year.

This second chart is the same graph on a new scale to fit the most recent federal reserve activity. Notice how you can't even see the bumps when we include this years lending topping out at over 600 billion.

Hats off to East Coast Economics; they published these graphs. Original article can be found here. Thought this would be interesting to share to help put a little perspective on what we are going through. Remember the Federal reserve is suppose to be the "lender of last resort." Right now banks can get money from the fed for 0.00% interest and then deposit it back with the Fed and earn .25% interest.

Hats off to East Coast Economics; they published these graphs. Original article can be found here. Thought this would be interesting to share to help put a little perspective on what we are going through. Remember the Federal reserve is suppose to be the "lender of last resort." Right now banks can get money from the fed for 0.00% interest and then deposit it back with the Fed and earn .25% interest.I promise I will get back to making posts I had originally planned when I started the blog but keeping up with the most recent economic news has kept me pretty busy and it's just too important to completely ignore.

TRC

Subscribe to:

Posts (Atom)